Best Practices for Developing a Secure and User-Friendly Banking App

In today’s digital age, consumers prefer using mobile apps for banking and financial transactions. Some examples include Apple Pay or Google Pay for contactless payments in stores; Banking apps to check account balances, transfer funds, pay bills, deposit checks via photo capture, and apply for loans or credit cards; insurance apps to pay premiums, file claims, and access roadside assistance; and many more.

While the convenience of using such mobile applications is undeniable, security and user experience are of utmost importance to ensure both the safety and satisfaction of users. Users expect their banking app not only to be intuitive and easy to use but also to keep their sensitive information safe. Here are the best practices for creating a secure and user-friendly banking app that meets the needs of both financial organizations and their end customers.

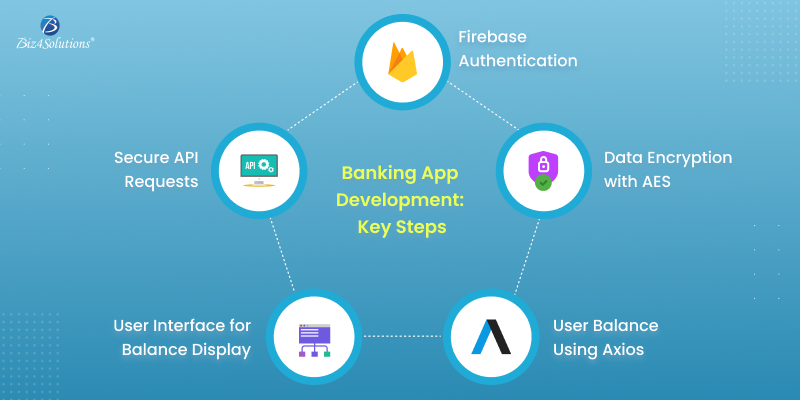

Banking App Development: Best Practices

User Authentication

Secure user authentication is the foundation of a safe banking app. A combination of methods—such as multi-factor authentication (MFA), biometric verification (fingerprints, facial recognition), and one-time passwords (OTPs)—creates multiple layers of security that deter unauthorized access. Using biometric authentication, for example, can enhance security while making the login experience fast and hassle-free for the user.

Best Practices:

- Implement 2FA or MFA as a standard protocol.

- Encourage users to enable biometric authentication

- Use session timeouts and automatically log out users after a period of inactivity.

Data Encryption and Secure Communication Channels

If you encrypt your data following standard mechanisms; any user wouldn’t be able to read or access it without the correct decryption key. End-to-end encryption secures data during transmission, while AES (Advanced Encryption Standard) can safeguard stored data.

Best Practices:

- Encrypt all kinds of sensitive data like personal details, account numbers, etc.

- Use SSL/TLS certificates so that data is transmitted securely.

- Update encryption techniques regularly to stay aligned with industry standards.

Implement Strong Access Controls

Access control is essential to prevent unauthorized access to user data and system resources. Role-based access control (RBAC) allows only authorized users and systems to access sensitive information or perform specific functions. This helps reduce the attack surface and limit potential damage from a data breach.

Best Practices:

- Use RBAC to define user permissions

- Review access logs for identifying unusual access patterns.

- Establish different user roles (e.g., user, admin) with distinct access levels.

Regular Security Audits and Penetration Testing

Banks should regularly conduct security audits and penetration testing to identify vulnerabilities and areas for improvement. These tests simulate potential attack vectors and help developers patch security flaws before they can be exploited.

Best Practices:

- Partner with third-party security firms for unbiased audits.

- Perform routine vulnerability assessments.

- Keep a continuous improvement cycle by scheduling regular security reviews.

User-Friendly Interface and UX Design

A secure banking app is only effective if users find it easy to use. The user interface (UI) should be designed for clarity, simplicity, and accessibility. The user experience (UX) in banking applications should minimize friction by making essential functions like logging in, viewing balances, and transferring money intuitive and quick.

Best Practices:

- Conduct user testing to optimize the app’s UI and flow.

- Use clear labeling and simple navigation.

- Focus on the essential features; avoid overloading users with too many options.

Compliance with Financial Regulations

Banks operate in a highly regulated environment, and financial apps must adhere to industry standards and government regulations such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) for data privacy.

Best Practices:

- Familiarize yourself with relevant regulations (GDPR, PCI DSS, CCPA).

- Implement data protection measures in compliance with these standards.

- Keep records of data handling and retention policies for audits.

Implement Fraud Detection and Prevention Mechanisms

Integrating real-time monitoring systems to detect fraudulent activity can help prevent unauthorized transactions. Leveraging AI and machine learning models can improve the detection of suspicious activities, especially those that differ from typical user patterns.

Best Practices:

- Set up alerts for unusual transaction behaviors.

- Integrate AI-driven fraud detection models.

- Allow users to freeze accounts and report suspicious activity directly through the app.

Regularly Update and Patch the App

Keeping the app updated is critical, as outdated software is vulnerable to attacks. Regular updates allow developers to apply patches that protect against newly discovered security threats. Furthermore, these updates can improve usability by fixing bugs and enhancing the app’s performance.

Best Practices:

- Set up a dedicated schedule for maintenance and updates.

- Communicate update benefits to users to encourage installations.

- Patch security vulnerabilities immediately upon discovery.

Educate Users on Security Best Practices

A secure app design alone is not enough if users are unaware of potential security risks. Informing users about the best practices, such as avoiding public Wi-Fi when accessing mobile banking apps and setting strong passwords, helps create an additional line of defence.

Best Practices:

- Send regular security tips and updates to users.

- Create in-app guides or FAQs on protecting accounts.

- Prompt users to review and update their security settings periodically.

Final Thoughts

Creating a secure and user-friendly banking app is a continuous process that requires a proactive approach to security and usability. By implementing these best practices, banks and financial institutions can ensure that their apps not only provide top-grade security but also a seamless and satisfying UX. The result? Higher user trust, better engagement, and a competitive edge over peers. Here’s a handy tip: If you don’t have a comprehensive in-house IT team, collaborating with a trusted IT partner can make all the difference.