Best Cross Platform App Development Language Revealed!

In today’s rapidly evolving digital landscape, the demand for cross platform app development has surged significantly. Businesses are striving to reach a wider audience by deploying applications that function seamlessly across multiple platforms, such as iOS, Android, and web. This approach not only ensures a broader user base but also optimizes development resources and reduces time-to-market.

Cross platform app development involves creating a single codebase that can run on different operating systems. This eliminates the need for separate teams to develop and maintain distinct versions of an application for various platforms. As a result, businesses can achieve a consistent user experience and uniform functionality across all devices.

Some of the key benefits of cross platform app development include:

- Cost Efficiency: Developing one codebase is more cost-effective than building multiple native apps.

- Faster Time-to-Market: A unified development approach accelerates the deployment process.

- Uniform User Experience: Ensures a consistent look and feel across different platforms.

- Easier Maintenance: Bugs and updates can be managed centrally, simplifying maintenance and support.

At Biz4Solutions, we specialize in delivering top-notch cross platform app development services that empower businesses to thrive in the competitive market. Our expert team leverages the latest technologies to create high-performance, scalable, and secure applications tailored to your unique requirements.

Importance of Choosing the Right Language

Choosing the right language for cross platform app development is crucial for the success of your project. The language you select will influence various factors such as development speed, performance, scalability, and maintenance. Therefore, making an informed decision is imperative for achieving your business goals.

One of the primary reasons the choice of language is so important is its impact on development efficiency. A language with robust libraries, frameworks, and tools can significantly accelerate the development process, reducing time-to-market. Moreover, a language that offers cross platform capabilities can streamline the coding process by allowing developers to write a single codebase that runs on multiple platforms.

Performance is another critical aspect to consider. The language should be capable of delivering high performance across different devices and operating systems. This is particularly important for applications that require real-time processing, such as gaming or financial apps. A high-performing language ensures that the app runs smoothly, providing a seamless user experience.

Scalability is also a key factor. As your user base grows, the app must be able to handle increased load without compromising performance. Choosing a language that supports scalable architecture will enable your app to grow alongside your business needs.

Lastly, ease of maintenance is vital for the long-term success of your app. A language with a strong developer community, extensive documentation, and regular updates will simplify the maintenance process, making it easier to fix bugs and implement new features.

In summary, the right language for cross platform app development not only enhances development efficiency but also ensures optimal performance, scalability, and ease of maintenance. Making an informed choice will set the foundation for a successful and sustainable application.

Top Cross Platform App Development Languages

When it comes to cross platform app development, several programming languages have distinguished themselves as top choices. These languages not only offer robust features but also ensure seamless performance across multiple platforms. Here are some of the top cross platform app development languages that developers widely use:

- JavaScript: JavaScript is a versatile language that powers many cross platform frameworks like React Native and Apache Cordova. It allows developers to use a single codebase to create apps for both Android and iOS, thereby reducing development time and effort.

- Dart: Developed by Google, Dart is the language behind the Flutter framework. Flutter has gained immense popularity for its capability to create natively compiled applications with a single codebase. Dart’s syntax is easy to learn, making it an attractive option for developers.

- Kotlin: Kotlin is officially supported by Google for Android development and can also be used for cross platform development via Kotlin Multiplatform. It offers concise syntax and interoperability with Java, making it a strong candidate for cross platform projects.

- Swift: While primarily used for iOS development, Swift can be integrated with cross platform frameworks like SwiftUI and Xamarin. It offers high performance and is known for its safety features, which help in building robust applications.

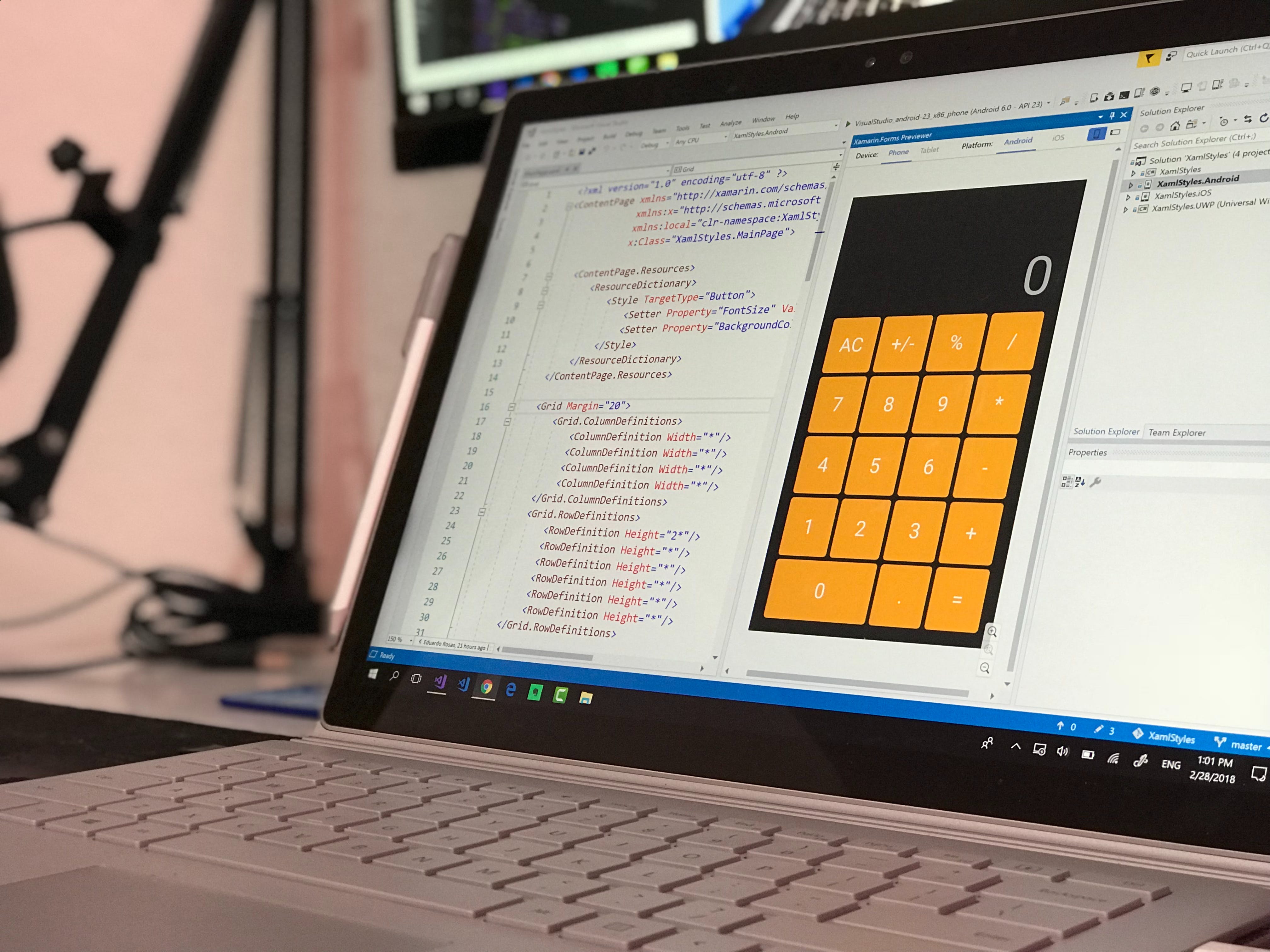

- C#: C# is the language of choice for the Xamarin framework, which allows developers to build apps for Android, iOS, and Windows with a single codebase. Its object-oriented structure and rich library support make it a reliable option for cross platform development.

- TypeScript: An extension of JavaScript, TypeScript offers additional features like static typing, which can help catch errors early in the development process. Frameworks like NativeScript and Angular leverage TypeScript for building cross platform apps.

Each of these languages offers unique benefits and can be selected based on the specific requirements of your project. Whether you prioritize development speed, performance, or ease of use, one of these top languages will likely meet your needs.

Key Features of Leading Development Languages

Understanding the key features of leading development languages is crucial in selecting the best one for your cross platform app development needs. Here, we delve into the distinct characteristics that set these languages apart from the rest:

- JavaScript: JavaScript is renowned for its high flexibility and extensive ecosystem. It supports asynchronous programming and offers numerous libraries and frameworks. Additionally, its compatibility with both web and mobile platforms makes it an excellent choice for cross platform development.

- Dart: Dart is celebrated for its fast performance and hot reload feature, which allows developers to see changes in real-time without restarting the app. Its strong typing system helps in catching errors early in the development process.

- Kotlin: Kotlin boasts clear and concise syntax, which reduces boilerplate code. It also offers full interoperability with Java, allowing developers to use existing Java libraries and frameworks seamlessly. Kotlin’s coroutines support simplifies asynchronous programming.

- Swift: Swift is designed for safety, offering features like optionals to handle null values and type inference to make code cleaner and less error-prone. Its performance is on par with traditional languages like C++, making it suitable for high-performance applications.

- C#: C# is an object-oriented language that offers robust features like LINQ (Language Integrated Query) for data manipulation and async/await for asynchronous programming. Its strong support for Windows development is a significant advantage.

- TypeScript: TypeScript extends JavaScript by adding static typing, which helps in identifying type-related errors during development. It also supports modern JavaScript features, making it backward compatible with JavaScript code and libraries.

These key features make each language uniquely suited for various aspects of cross platform app development. By understanding these characteristics, you can make an informed decision on which language best aligns with your project’s requirements.

Comparative Analysis of Development Languages

Performing a comparative analysis of the leading development languages helps in understanding which one stands out as the best cross platform app development language. Here, we compare some of the top languages based on various criteria:

- Performance: Languages like Swift and Dart are known for their high performance. Swift’s execution speed is comparable to C++, making it ideal for resource-intensive applications, while Dart’s just-in-time (JIT) and ahead-of-time (AOT) compilation ensure swift performance.

- Ease of Learning: JavaScript and TypeScript are often highlighted for their ease of learning. JavaScript’s widespread use and extensive online resources make it accessible for beginners, while TypeScript’s additional static typing provides a smoother learning curve for those familiar with JavaScript.

- Community Support: JavaScript, being one of the most popular languages, boasts an enormous community, offering abundant resources, libraries, and frameworks. Kotlin and Swift also have strong communities, though smaller in comparison, providing essential support and continuous updates.

- Tools and Libraries: JavaScript and TypeScript lead in terms of available tools and libraries. Frameworks like React Native and Angular are widely used. Dart, with Flutter, offers a powerful toolkit for building natively compiled applications for mobile, web, and desktop from a single codebase.

- Scalability: C# and Kotlin are known for their scalability. C#’s robust architecture and integration capabilities make it suitable for large-scale enterprise applications, while Kotlin’s interoperability with Java facilitates seamless scaling in existing Java-based systems.

- Development Speed: Dart’s hot reload feature significantly accelerates the development process, allowing developers to see changes instantly. Similarly, JavaScript’s vast ecosystem and extensive libraries enable rapid development cycles.

This comparative analysis reveals that each language excels in different areas, making them suitable for various types of cross platform app development projects. The choice of the best language depends on specific project needs, such as performance requirements, scalability, and development speed.

Final Thoughts on Choosing the Best Language

Choosing the best cross platform app development language ultimately boils down to assessing your project’s specific requirements and constraints. Each language offers unique advantages and caters to different aspects of development, from performance and scalability to ease of learning and community support.

For example, if you prioritize performance and a robust toolset, languages like Swift and Dart might be the best fit. On the other hand, if you seek a language with extensive community support and a wealth of resources, JavaScript and TypeScript could be more suitable. When scalability is a major concern, C# and Kotlin stand out due to their seamless integration capabilities and strong architecture.

It’s also important to consider the development speed, where JavaScript and Dart excel thanks to their extensive libraries and features like hot reload. The key is to align the choice of language with your project’s goals, whether it’s rapid development, high performance, or ease of maintenance.

At Biz4Solutions, we understand the critical role of selecting the right development language. Our expert team is well-versed in leveraging the strengths of various languages to deliver top-notch cross platform applications tailored to your business needs.

Embark on your app development journey with confidence! Reach out to us at biz4solutions.com to explore how we can help you choose and implement the best language for your next project.