We are living in a cashless economy, where digital wallets, instant payments, and global transactions are the norm. Sounds futuristic indeed! However, you mustn’t ignore the fact that with advancements in tech, fraudulent practices too have become smarter, faster, and harder to detect. Cybercriminals are making use of automation and even AI to invent sophisticated tactics for cyber attacks. To fight back, financial institutions are deploying AI-powered machine learning (ML) solutions that deliver real-time protection, predictive intelligence, and adaptive defence strategies. Let’s explore!

How are the latest innovations transforming Fraud Detection and reshaping the future of Financial Security?

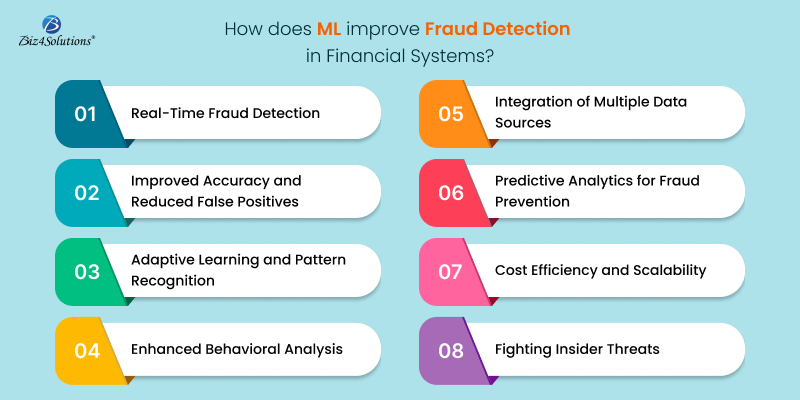

- Real-Time, AI-Driven Anomaly Detection

- Next-Level Accuracy with Explainable AI

- Adaptive Defense Against Emerging Threats

- Behavioral Biometrics and Predictive Intelligence

- Multi-Source Data Fusion with Cloud-Native Architectures

- Predictive Analytics for Fraud Prevention

- Cost-Effective Automation at Scale

- Detecting Insider Threats with Advanced Analytics

Legacy fraud detection systems often run on static, rule-based engines. In contrast, real-time anomaly detection models powered by ML and deep learning continuously analyze millions of transactions across channels. Whether it’s card-not-present fraud or suspicious cross-border payments, these models can instantly flag unusual behavior—reducing the fraudster’s opportunity window to near zero.

Traditional systems may incorrectly flag legitimate transactions as fraudulent; such “false positives” frustrate customers and drain operational costs. Balancing accuracy with the reduction of false positives may be challenging. Explainable AI (XAI) brings transparency to fraud models, ensuring high detection accuracy while clearly explaining why a transaction was flagged. This not only minimizes customer friction but also helps compliance teams stay aligned with regulatory requirements like GDPR and PCI-DSS.

Fraud tactics are evolving constantly to bypass detection. Hence, synthetic identities, phishing, and AI-generated deepfake scams are rising. And, it’s becoming challenging for the conventional rule-based systems to cope up with such changing schemes. Machine learning, on the other hand, thrives on adaptability. Unsupervised ML and reinforcement learning empower fraud systems to self-learn from new attack vectors, spotting patterns no human analyst could detect. This adaptive defense ensures financial platforms remain future-proof.

Modern fraud detection goes beyond static transaction checks. By analyzing behavioral biometrics—typing speed, mouse movements, device fingerprinting—AI builds a unique digital identity for each customer. Predictive intelligence models then forecast high-risk behavior before fraud even occurs, enabling proactive intervention.

Fraud rarely leaves traces in one dataset. ML models now pull from multi-source data streams—transaction history, geolocation, IoT device data, social media activity, and even blockchain networks. Advanced techniques like graph-based ML models can uncover hidden relationships between data points, identifying complex fraud networks that might otherwise go undetected. With cloud-native and microservices-based architectures, these fraud engines scale effortlessly, protecting billions of transactions in milliseconds.

Machine learning doesn’t just detect fraud; it can also predict and prevent it. Predictive analytics, powered by ML, identifies high-risk areas and potential vulnerabilities within financial systems. By proactively addressing these risks, financial institutions can implement measures to reduce the likelihood of fraud occurring in the first place.

Manual fraud investigation teams are labor-intensive and costly. AI automation reduces fraud management costs by streamlining case triage, prioritizing alerts, and even auto-resolving low-risk cases. Financial enterprises can now scale protection as transaction volumes explode, without ballooning operational expenses.

Fraud isn’t just an external threat. Insiders with privileged access pose hidden risks. AI models trained on user behavior analytics (UBA) can detect anomalies in employee actions—such as irregular access logs or unusual data extraction—helping institutions uncover insider fraud before damage occurs.

Final Thoughts

Fraud detection is no longer about chasing yesterday’s threats. With AI-driven machine learning, deep learning algorithms, and predictive analytics, financial systems can build self-learning, scalable, and highly accurate defenses. As generative AI and blockchain integrations gain traction in fintech app security, fraudsters will face an increasingly hostile environment. For banks, neobanks, and fintech startups, investing in next-gen, AI-powered fraud detection platforms isn’t just a security measure—it’s a competitive advantage that strengthens customer trust in a digital-first financial world.