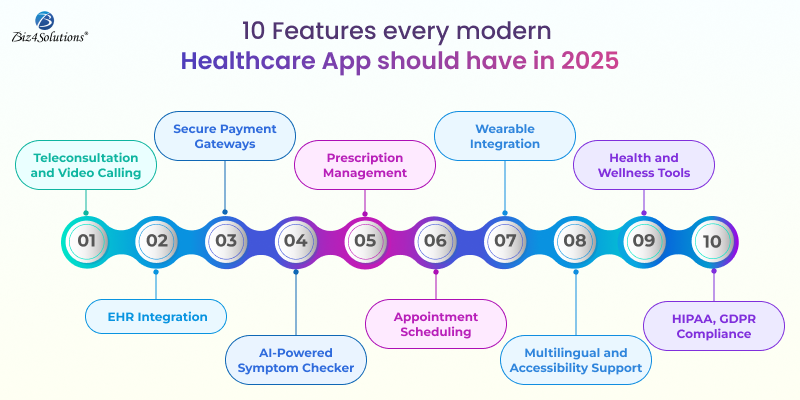

Crucial Features Every Modern Healthcare App Should Have in 2025

The digital healthcare industry is booming, driven by rapid advancements in technology and an increasing demand for accessible, patient-centered care. In an era where over 4 billion people own smartphones, healthcare apps have become a lifeline, connecting users with vital services at the tap of a screen. Whether it’s managing chronic conditions, scheduling consultations, or promoting wellness, these apps are revolutionizing how we approach health and wellness. But what makes a healthcare app truly stand out in this competitive market? This blog highlights the essential features that every modern healthcare app must have in 2025 to bridge gaps in healthcare delivery, foster trust, and empower users to take control of their health.

Top Healthcare App Trends

1. Teleconsultation and Video Calling

Why It’s Essential: Teleconsultation has transformed how patients access healthcare by bridging the gap between them and healthcare professionals. Remote consultations save time, reduce travel costs, and allow patients to consult with specialists regardless of their location. This feature has become especially vital during emergencies, pandemics, or when patients are in remote areas.

Features: Modern healthcare apps should offer HD video and audio calling capabilities to ensure clear communication between doctors and patients. An intuitive appointment scheduling system allows users to book consultations conveniently. Additionally, secure interactions—ensured through end-to-end encryption—build trust by protecting sensitive medical conversations. Features like virtual waiting rooms and integration with electronic prescriptions further enhance the teleconsultation experience.

2. Electronic Health Records (EHR) Integration

Why It’s Essential: Electronic Health Records (EHR) integration centralizes patient information, making it accessible to both patients and healthcare providers. This functionality eliminates the need for repetitive medical history inquiries and helps healthcare professionals make informed decisions faster.

Features: An EHR system should enable users to view and update their medical history, test results, prescriptions, and vaccination records in real-time. Patients can track their progress, while doctors gain instant access to critical information, ensuring continuity of care. Integration with labs and pharmacies allows seamless updates on diagnostic results and medication schedules, fostering a holistic approach to health management.

3. Secure Payment Gateways

Why It’s Essential: Secure and seamless payment processing is critical for healthcare apps, as it ensures users can pay for consultations, tests, and medications without hassle. Ensuring secure transactions builds trust among users and reduces the risk of financial fraud.

Features: Healthcare apps should support multiple payment methods, including credit/debit cards, digital wallets, and UPI (Unified Payments Interface). Advanced encryption protects sensitive financial data during transactions. Additional features like payment history tracking, automated reminders for upcoming payments, and split payment options for family accounts enhance user convenience.

4. AI-Powered Symptom Checker

Why It’s Essential: An AI-powered symptom checker empowers users to take the first step toward understanding their health concerns. It’s particularly useful for minor ailments or for determining whether a condition requires urgent medical attention.

Features: An interactive, chat-based interface guides users through a series of questions to analyze symptoms. The tool can provide preliminary advice, potential diagnoses, and recommendations for further steps, such as scheduling a teleconsultation or visiting a specialist. Integration with the app’s teleconsultation feature ensures users can act on advice immediately, enhancing the overall healthcare experience.

5. Prescription Management

Why It’s Essential: Managing medications effectively is crucial for patients with chronic conditions or complex treatment regimens. Prescription management features simplify this process, reducing the chances of missed doses or medication errors.

Features: Users should be able to store and access digital prescriptions within the app. Refill reminders can be set to notify patients when it’s time to reorder medications. Integration with partner pharmacies allows one-click prescription refills and doorstep delivery. These features not only improve medication adherence but also enhance patient convenience.

6. Appointment Scheduling

Why It’s Essential: A streamlined appointment scheduling system is essential for reducing no-shows and ensuring patients can book consultations easily. It simplifies the process for both users and healthcare providers.

Features: Modern apps should offer calendar integration to help users track their appointments. Real-time availability of doctors ensures transparency and reduces scheduling conflicts. Rescheduling and cancellation options make the system flexible, while automated reminders via SMS, email, or in-app notifications help patients remember their appointments.

7. Wearable Integration

Why It’s Essential: Wearable devices provide real-time health data that can be leveraged to offer personalized care. This integration bridges the gap between daily health monitoring and professional healthcare advice. The popular portal Fortune Insights forecasts that the global wearable healthcare devices market will grow at a CAGR of 17.2% between 2024 and 2032. During this forecast period the market valued at USD 91.21 Billion in 2024 will reach USD 324.73 Billion by 2032.

Features: Apps should connect seamlessly with wearables like fitness trackers and smartwatches to collect data on vitals such as heart rate, steps, sleep patterns, and more. This data can be synced with the user’s EHR for comprehensive insights. Advanced analytics can identify trends, send alerts for abnormal readings, and provide recommendations for lifestyle changes or medical attention.

8. Multilingual and Accessibility Support

Why It’s Essential: Making healthcare apps accessible to a diverse audience, including non-English speakers and individuals with disabilities, ensures inclusivity and expands the app’s reach.

Features: Apps should offer multiple language options with accurate translations to cater to a global audience. Voice-guided navigation aids visually impaired users, while compliance with accessibility standards (like WCAG) ensures the app can be used by individuals with varying abilities. Features like adjustable font sizes, color contrast settings, and text-to-speech functionality further enhance accessibility.

9. Health and Wellness Tools

Why It’s Essential: Preventive care and healthy habits are essential for reducing the risk of chronic illnesses. Health and wellness tools encourage users to take charge of their well-being.

Features: Apps should include personalized diet plans, fitness tracking, and mental health support. Guided meditation sessions and stress management tools can enhance mental well-being. Features like water intake reminders, sleep tracking, and step goals foster a holistic approach to health. Gamification elements, such as rewards for meeting health goals, can further motivate users.

10. HIPAA and GDPR Compliance

Why It’s Essential: Adhering to privacy regulations like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) is non-negotiable for healthcare apps. Compliance ensures user data is handled securely and builds trust.

Features: The app should have robust data encryption protocols to secure sensitive information. User consent management features allow patients to control how their data is used. Regular compliance updates and audits ensure the app stays aligned with evolving regulations. Features like secure cloud storage and detailed privacy policies further enhance data protection.

Takeaways

The demand for healthcare apps is skyrocketing, with users seeking innovative, user-friendly, and industry-compliant solutions. As you embark on the healthcare app development process, it’s crucial to address these key factors. The ten features highlighted in this post collectively meet the most critical needs of modern healthcare app users. From teleconsultation and AI-driven tools to secure payment gateways and wearable integration, these functionalities are at the forefront of transforming the healthcare industry.